With the ageing of the population having become an investment megatrend, investors need to assess what consumer-led changes are likely to occur.

Investment Megatrends are powerful transformative forces that change the economy, business and society and have been changing the way we live for centuries. Electricity, cars and the internet are some common examples.

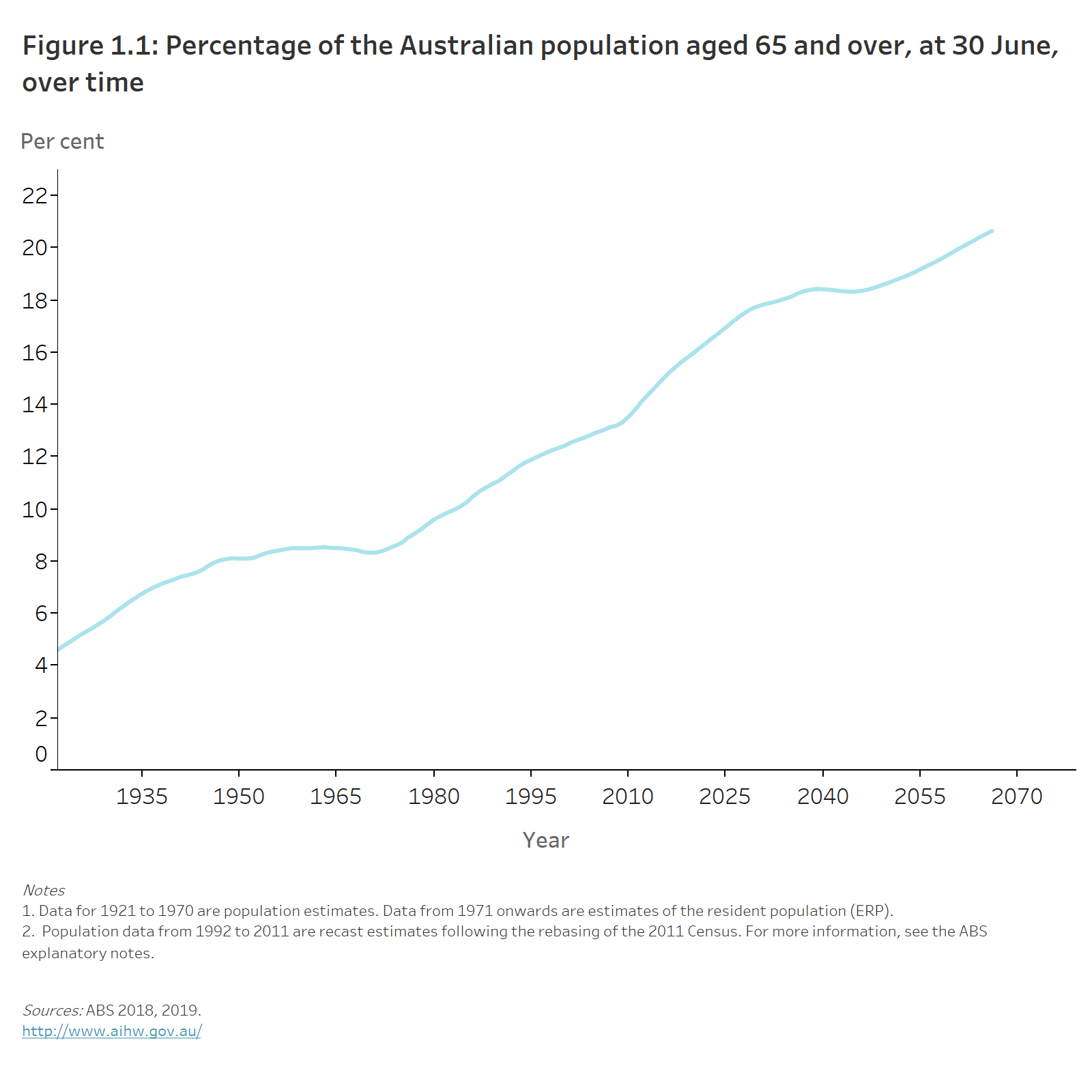

Nick Markiewicz, a portfolio manager from Lanyon Asset Management says the Australian population is ageing quickly as a result of declining fertility rates as living standards rise, as well as rising life expectancy. Based on current demographic forecasts from the Australian Institute of Health and Welfare, the proportion of Australia’s population aged over 65 has more than tripled from around 5% in 1922 to 16% currently and is expected to increase to 21% by 2066. In other words, the population over 65 is expected to grow at twice the rate of the Australian population more broadly.

Investors need to assess what consumer led changes are likely to occur as the population ages. Older people with more leisure time tend to travel, require financial services, get sick more often which can also lead to changes in accommodation, and ultimately die.

At an economic level, other changes that are likely include a slowdown in GDP growth as the working age population stagnates, rising deficits as the Government has fewer workers which it can tax to fund higher spending on aged care and healthcare programs. These programs, coupled with pension spending account for a quarter of commonwealth spending and are projected to rise significantly.

Nathan Bell, Head of Research at Intelligent Investor believes that the ageing population is great news for Australia’s healthcare companies. Some are the world’s best including Sonic Healthcare (pathology), CSL (blood products and biotech), Resmed (sleep apnea) and Cochlear (hearing).

Bell says that the older Australia’s population gets, the sicker it gets and the more medical tests are required from the likes of Sonic Healthcare. The number of pathology tests conducted in Australia has increased from 119.5m in 2015/2016, to 150.9m in 5 years. (Source: https://aihw.gov.au) This represents a compound growth rate of around 5% per annum which means that the pathology industry is growing at a faster rate than the broad economy. Bell is of the view that Sonic is reasonably priced due to fears of falling revenue due to fewer COVID tests, however the base business (ex-COVID testing) is in good shape and growing steadily.

Another medical industry benefitting from the ageing population is diagnostic imaging. Growth in diagnostic imaging has been at a similar pace to pathology with the number of services rising from 22.8m in 2015/2016 to 27.7m in 2020/2021. (Source http:aihw.gov.au) Bell likes a radiology company, Integral Diagnostics in this sector. Bell flags that Intregral’s profits have been hurt by restricted medical procedures during COVID lockdowns, but if they recover and recent acquisitions pay off then it could once again regain favour in the market and reward investors.

One of the biggest risks to healthcare companies is the potential for Government to change healthcare rebates, particularly as pressure grows on Government deficits.

It is this reason that Markiewicz is preferring to play the ageing of the population via the financial services sector. Markiewicz puts forward Challenger as a beneficiary of the ageing population as they provide annuities to retirees, offering them protection against the risk of outliving their savings. Challenger is by far the largest provider of annuities in Australia with a market share exceeding 80%. Markiewicz expects Challenger to benefit from a growing target market and increasing take up of annuities over time which is likely to be enhanced by regulatory reforms by Governments such as the Retirement Income Covenant.

Investing on a megatrend thematic alone is an easy way to lose money. Investors must ensure they are avoiding substandard or risky businesses within sectors that on the surface are beneficiaries of the ageing population. Both Markiewicz and Bell nominate the aged care sector as one to tread carefully, despite mouth watering demographic changes. This is because a large portion of their earnings are derived from Government funding. After Government cuts to age care funding in 2016, the listed ASX aged care providers share prices fell sharply. The recent Royal Commission into the aged care sector has also resulted in rising costs.

Megatrends are not a guarantee of investor success, but there can be important tail winds to recognise.

Mark Draper writes monthly for the Australian Financial Review - this article was published in the Wednesday 3rd May 2023 edition