Mark Draper (GEM Capital) writes a monthly column for the Australian Financial Review. This article outlines the generational opportunity that is before investors in the doubling of the Chinese middle class in the next 5 years. It was published during February 2019.

The growth in Chinese middle class is one of the strongest demographic opportunity for investors in a generation. Most investors however, including the Global indices, have little in the way of exposure to this theme.

Chinese middle class is forecast to double from around 300 million to 600 million people in the next 5 years. While the definition of middle class varies widely, it is commonly characterised to include those but the poorest 20% and the wealthiest 20%. It is natural as more people enter the middle class they will have more disposable income to spend on discretionary purchases. Buying cars, property, healthcare, mobile phones and a change of diet are all examples of the opportunities that exist for investors from this demographic trend.

Vihari Ross, Head of Research at Magellan Financial Group points to coffee consumption in China as a long term opportunity. Those with even modest discretionary income can afford this ritual. Chinese annual coffee consumption is less than 1 cup per year per capita, versus the US consumption of around 300 cups per year per capita.

Growth in Chinese coffee consumption is one of the key drivers behind Magellan’s investment into Starbucks according to Ross. There are currently 3,400 Starbucks stores currently in China, the company is forecast to open 600 new stores in China each year for the next 5 years, which equates to annual growth of 15%. With a pre-tax return of 85% on investment from these stores the investment case seems compelling.

Source: Magellan Financial Group

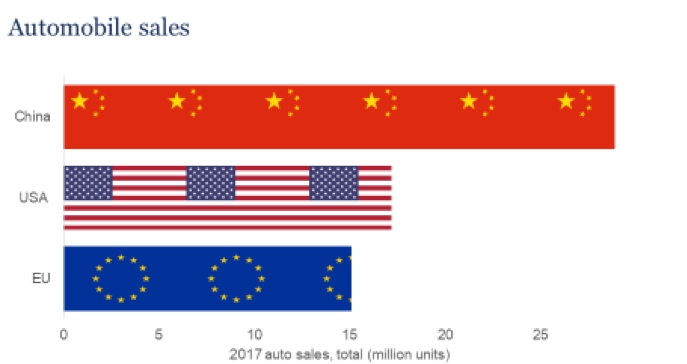

Andrew Clifford, CEO Platinum Asset Management says “China is the world’s largest physical market – not just for iron ore and copper but everything imaginable: aeroplanes, autos, mobile phones, semiconductors, running shoes and luxury handbags. Indeed, it is hard to imagine a physical market for which China is not the largest customer.”

Source: Platinum Asset Management

With growing car ownership in China, comes the need for insurance. This helps explain Platinum’s investment into Ping An Insurance Group, the number 1 global insurance company on the 2018 Forbes Global 2000 list. Ping An, which trades on a price earnings multiple of around 11 is growing rapidly and boasts a technology-first mindset. Its Fintech capabilities are world class and its health business and life insurance businesses are also booming. Needless to say, there are very few listed companies in Australia trading on a price earnings multiple of 11 that are growing their earnings.

To help put further perspective on what the next 5 years might look like for Chinese middle class, we look back 5 years. Dinner party conversations will be enriched by wheeling out some of these Chinese growth statistics. In 2014 there were 25 million motor vehicles sold in China and in 2018 the number was 28 million. Chinese box office revenue in 2014 was $5bn and in 2018 it took in $9bn. There were 640 million internet users in 2014 and in 2018 there were more than 800 million. 109 million overseas visitors entered China and in 2018 the number of tourists was over 150 million. 14 billion express post parcels were delivered in 2014 and in 2018 parcel delivery grew to over 50 billion parcels. 32 million Chinese passengers flew domestically every month in 2014, rising to around 50 million passengers per month in 2018. (statistics courtesy of Platinum Asset Management)

To cope with the surge in air travel, China plans to build over 70 new civil airports by 2020 to make the total 260. That’s up from 175 in 2010. The opportunity for inbound tourism into Australia is enormous (and bolsters the investment case for Sydney Airport).

The numbers are phenomenal and difficult to grasp for many Australians. More importantly, investors who base the majority of their investments domestically are ignoring this generational tailwind.

Clearly there will be peaks and troughs in the Chinese economy, although it is still growing at around 6% per year, good by Western measures. Just the growth of the Chinese economy each year is larger than the entire Australian economy.

Investors would be wise to look through the short term economic cycles and embrace the extraordinary opportunity that is before them.