One of the most solid results for us this reporting season was Ampol, one of our top 5 holdings. It is the largest fuel supplier to the Australian and New Zealand market with a vertically integrated operation, supplying fuel to industrial customers and retail customers through the Ampol brand in Australia and the Z Energy brand in New Zealand. It also operates one of the two refineries left in Australia, Lytton.

Coming out of Covid, Ampol has recovered strongly. Our positive view rests on not just the short-term tailwinds but also on a favourable medium-term outlook and improved business quality. Ampol today is more cash generative, can sustain higher dividends, and many areas of the business have been derisked and are well set up.

Business quality

Australia and New Zealand currently have one of the largest short positions of petroleum product in APAC. Over the last decade, Australia has shifted from relying on fuel imports for 25% of its supply to now 75%. New Zealand has gone further, shutting down all its domestic refineries and importing 100% of its fuel. Increasing reliance on imports favours players like Ampol with their extensive infrastructure assets that can yield better asset returns and supply fuel at a competitive cost. This dynamic also underpins the rationale behind the company’s acquisition of Z Energy, which has been performing strongly and is a greater than 20% Return on Invested Capital (ROIC) investment for the company.

Refining margins are inherently volatile, and at times we have seen Lytton swing to a loss. In 2021, the threat of Lytton’s closure led to a favourable agreement with the Australian government, which will provide government support in a downturn to ensure the asset remains viable to supply into the domestic market. The Australian government did not want to go down the New Zealand route of closing all refineries and relying on fuel imports. This would leave Australia in a precarious situation if global geopolitics shifted and we did not have a domestic source of production. This deal effectively caps potential losses at Lytton at zero, and allows Ampol all the earnings upside, dramatically reducing the volatility of Ampol’s earnings. That said, we don’t believe the agreement will cost the government much – we expect restricted global supply and stronger controls over Chinese refining exports should be supportive of Lytton’s medium-term earnings outlook.

In convenience retail, business quality and industry setup have also improved. Ampol and others are investing to improve their retail offering (Quick Service Restaurant, improving range, store refurbishment) and we think Ampol has a strong competitive position. This strategy will also be increasingly important to adapt to a future of EVs.

Ampol was earlier to embark on this strategy than its peers, starting in 2016, and although it has not been the smoothest journey, we think Ampol is well positioned now. Investors, ourselves included, can often underestimate the complexity involved in a retail transformation. It’s easy for us to look to growth without appreciating the nuances like procurement, costs or systems. After seven years of hard work, we think Ampol finally has a strong foundation. The company has taken control of its network from franchisees, allowing it to better implement retail initiatives, reconsolidated to a smaller set of profitable sites with a focus on highway sites, which have stronger returns, and built retail capabilities. Incidentally, I recently drove to and from Sydney and the Gold Coast over the Easter break. With two young kids in the car, we must have stopped at least eight or nine times. Every single petrol station we visited up and down the Pacific Highway was an Ampol site – we think Ampol’s highway-heavy site portfolio has stronger earnings potential and less EV disruption risk.

Beyond the shop, the retail fuel side has also improved. Counterintuitively, headwinds like inflation, tobacco and EV help widen the gap between the most profitable and scaled players from the marginal players. In a fragmented industry like this, marginal retail operators need to remain viable through fuel pricing, and the high cost of doing business helps enforce rational competition. We see similar trends playing out in North America. Again, going back to the network strength, we think Ampol is well positioned here with profitable sites, more premium fuel, and rent advantage through more freehold property. All in all, we think the quality and earnings potential in Convenience Retail is underappreciated.

Management quality

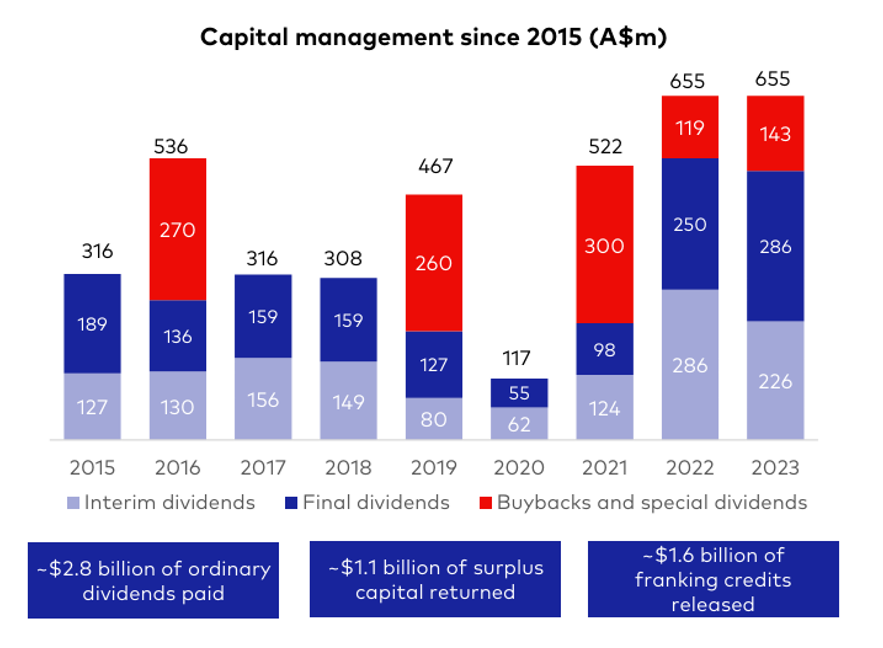

Management has executed well with their reset of the convenience retail, securing Lytton support, Z Energy acquisition and track record in capital recycling. Since 2015, Ampol has returned $5.5bn of capital to shareholders (more than half of its market cap today).

Source: Ampol

Financial strength

When we compare Ampol to its peers on the ASX, like energy and utilities, we come away with the following assessments: 1) it is more cash generative and can sustain higher dividends; 2) the market structure, especially retail, is much more favourable and reliable; 3) strong ROIC (15% pre-tax); and 4) strong balance sheet. At 13.8x PE, we think the risk/reward looks attractive, particularly considering the average ASX Industrial stock trades on 23x PE despite earning an inferior 13% pre-tax ROIC.

ESG Consideration

We believe the energy transition has weighed on Ampol’s multiple, as it is viewed as a ‘loser’ in the inevitable shift to EVs. While it’s probably fair to say that EV penetration might take longer in Australia, we also don’t want to fool ourselves into thinking that “it will take so long that it won’t affect our investments”. Although the company is actively involved in future energy (piloting EV charging, potential biofuel operation), it’s important for us to understand the potential economic impact. This is essential to our process.

We spoke to Alimentation Couche-Tard, one of the largest convenience retail operators globally with the #1 position in Norway. Norway is an important test case for the impact of EV penetration on convenience retail profitability, given EVs comprise >90% of new car sales there. Couche-Tard sees strong demand for on-the-go charging, healthy charging economics for the electrons, uplift in shop sales from longer dwell time, and strong fuel performance. Couche-Tard made it clear to us that EVs do not displace fuel earnings but rather add to it. Fuel performance continues to surprise to the upside, especially in industries that find it even more difficult to transition. Couche-Tard is more profitable in Norway with EVs than without.

Similarly, McKinsey estimates that by 2030 on-the-go charging and destination charging in Norway will make up ~75% of EV charging profit pools but only around 40% percent of total power demand. In contrast, home charging will provide 25% of power demand but will account for only 12% of profit pools.*

Regardless of geographies, we think the economics of public EV charging will be driven by the limited availability of attractive charging locations. We think this adds to the model in Australia with a constrained electricity transmission network and vast distances between cities, making the real estate and network strength even more critical and valuable.

Source: Company filings

* https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/what-norways-experience-reveals-about-the-ev-charging-market#/

This article has been reproduced with permission from Airlie Funds Management