•The Westpac Melbourne Institute Index of Consumer Sentiment rose by 1.6% in September from 96.6 in August to 98.2 in September

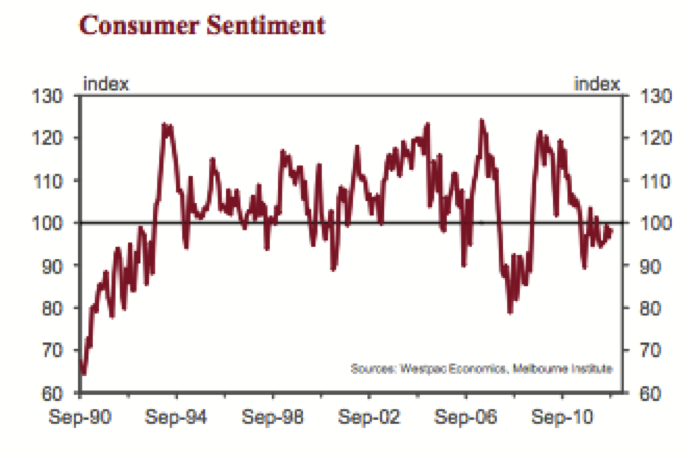

This is the seventh consecutive month that the Index has been below 100. Apart from the 2008/09 period when the Index held below 100 for 16 consecutive months this represents the longest run of consecutive ‘sub 100’ prints since the early 1990s. Furthermore, there have only been two months in the last 15 when the Index has printed above 100.

The consumer is clearly stuck in an extended ‘cautiously pessimistic’ phase. In September last year the Index printed 96.9 so it has only increased by 1.3% over the whole year. That is despite 1.25% of rate cuts from the Reserve Bank; a more or less steady unemployment rate which is close to full employment; and some recent positive news around the threatening European situation.

This does not bode well for consumer spending and is consistent with the slowdown in consumer spending indicated by the June quarter national accounts. Although this followed a strong March quarter rise, the softening has come despite major policy boosts to household incomes including $1.9bn in fiscal handouts. With a sharp fall in July retail sales confirming this boost is now reversing, underlying momentum appears to be soft, in line with the consistently downbeat signal from the Consumer Sentiment Index.

Media coverage is often a major factor shaping respondents’ confidence including how they assess their own financial position and how they evaluate macro issues.

In the September report we receive an update on the news items which are capturing the attention of consumers and whether these were favourable or unfavourable. It shows the dominant news in September was around ‘economic conditions’ with 47% recalling news on this issue. Next was ‘budget and taxation’ (39.8% recall); international conditions (25.5% recall); and employment/wages (20.6% recall). Other topics registering lower recall include covered interest rates; inflation; politics and the Australian dollar.

Since June, the overall sentiment Index has increased by a modest 2.7%. Respondents generally recalled slightly less unfavourable news on international conditions although these items were still overwhelmingly negative. Other news was viewed as even more unfavourable than in June.

Four of the five components of the Index increased with the sub- indexes tracking views on “family finances compared to a year ago” up 0.3%; “family finances over the next 12 months” up 4.8%; “economic conditions over the next 12 months” up 0.6% and “economic conditions over the next 5 years” up 3.4%. The sub- index tracking views on “whether it is a good time to buy a major household item” fell by 0.4%.

By June this year we were particularly concerned by readings on “family finances over the next 12 months” which was printing at a level around the low-point of the 2008-09 period. Since thenwe have seen an encouraging improvement in this component which has increased by 11.4%. However it is still at a historically low level. For example the average print of that component during that 2008/09 period when the Index registered 16 consecutive months below 100 was 105.2 – today’s print of 96.2 is still well below that average. We can only conclude that respondents remain concerned about their finances despite the recent rally.

This survey also provides a quarterly update on respondents’ savings preferences. There was a sharp increase in the proportion of those respondents who assess bank deposits to be the wisest place for savings, with that proportion increasing from 32.6%

in June to 39.0% in September. That proportion is the highest proportion since December 1974 and comfortably exceeds the peak proportion during the 2008/09 period of 36.9%. For this survey the 6.4ppt increase in preference for bank deposits was at the expense of real estate which fell from 25.0% in June to 19.8% in September. The proportion of respondents favouring shares stayed near record lows at 5.5%, while the proportion opting for ‘pay down debt’ was steady at 20.4%.

If we compare the total proportion of respondents who prefer conservative savings options, covered by bank and other forms of deposits in conjunction with “pay down debt” the current proportion registers 63.5% of respondents. That compares with 64.2% in December 2008 when we were at the height of risk aversion during the Global Financial Crisis. In short, respondents are exhibiting a similar level of risk aversion in terms of their savings preferences as we saw in 2008.

The Reserve Bank Board next meets on October 2. Our forecast has been and remains that the Bank will decide to cut the official cash rate by 50bps over two meetings by year’s end. The case for lower rates is strong. Inflation remains well contained and the Bank’s own forecast has inflation remaining consistent with the target over the next one to two years. Interest rates are only slightly below neutral levels. The June quarter national accounts showed that consumer spending is slowing and investment in residential construction and plant and equipment has been contracting for the last few quarters. Despite a near 10% fall in the terms of trade the Australian dollar has failed to perform its usual ‘shock absorber’ role. Fiscal policy at both Federal and

|

state levels is tightening. Both consumer and business confidence are soft. From a domestic perspective only the fall in the unemployment rate and the ongoing surge in mining investment counter the case for lower rates. However, the fall in the unemployment rate has been due to discouraged workers leaving the workforce while the medium term outlook for the mining investment has recently been revised down by some mining companies. In short, we think the case for lower rates has already been made and there must be a reasonable chance that the Bank will decide to move in October. However, central banks are conservative so a November ‘call’ for the first move looks to be more prudent. Bill Evans, Chief Economist

Disclaimer Westpac Institutional Bank is a division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714 (‘Westpac’). This document is provided to you solely for your own use and in your capacity as a wholesale client of Westpac. The information contained in this communication does not constitute an offer, or a solicitation of an offer, to subscribe for or purchase any securities or other financial instrument; does not constitute an offer, inducement or solicitation to enter a legally binding contract. The information is general and preliminary market information only and while Westpac has made every effort to ensure that information is free from error, Westpac does not warrant the accuracy, adequacy or completeness of the Information. The information may contain material provided directly by third parties and while such material is published with necessary permission, Westpac accepts no responsibility for the accuracy or completeness of any such material. Although we have made every effort to ensure the information is from error, Westpac does not warrant the accuracy, adequacy or completeness of the information, or otherwise endorse it in any way. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice and Westpac is under no obligation to update the information or correct any inaccuracy which may become apparent at a later date. Past performance is not a reliable indicator of future performance. The forecasts given in this document are predictive in character. Whilst every effort has been taken to ensure that the assumptions on which the forecasts are based are reasonable, the forecasts may be affected by incorrect assumptions or by known or unknown risks and uncertainties. The ultimate outcomes may differ substantially from these forecasts. This communication does not constitute a personal recommendation to any individual investor. In preparing the information, Westpac has not taken into consideration the financial situation, investment objectives or particular needs of any particular investor and recommends that investors seek independent advice before acting on the information. Certain types of transactions, including those involving futures, options and high yield securities give rise to substantial risk and are not suitable for all investors. Except where contrary to law, Westpac intends by this notice to exclude liability for the information. The information is subject to change without notice. A product disclosure statement (“PDS”) may be available for the products referred to in this document. A copy of the relevant PDS and a copy of Westpac’s Financial Services Guide can be obtained by visiting www.westpac.com.au/ disclosure-documents. You should obtain and consider the relevant PDS before deciding whether to acquire, continue to hold or dispose of the applicable products referred to in this document. This document is being distributed by Westpac Banking Corporation London Branch and Westpac Europe Limited only to and is directed at a) persons who have professional experience in matters relating to investments falling within Article 19(1) of the Financial Services Act 2000 (Financial Promotion) Order 2005 or (b) high net worth entities, and other persons to whom it may otherwise be lawfully be communicated, falling within Article 49(1) of the Order (all such persons together being referred to as “relevant persons”). The investments to which this document relates are only available to and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such investments will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely upon this document or any of its contents. In the same way, the information contained in this document is intended for “eligible counterparties” and “professional clients” as defined by the rules of the Financial Services Authority and is not intended for “retail clients”. With this in mind, Westpac expressly prohibits you from passing on this document to any third party. In particular this presentation and any copy of it may not be taken, transmitted or distributed, directly or indirectly into the United States and any other restricted jurisdiction. This document has been approved solely for the purposes of section 21 of the Financial Services and Markets Act 2000 by Westpac Banking Corporation London Branch and Westpac Europe Limited. Westpac Banking Corporation is registered in England as a branch (branch number BR000106) and is authorised and regulated by The Financial Services Authority. Westpac Europe Limited is a company registered in England (number 05660023) and is authorised and regulated by The Financial Services Authority. Westpac operates in the United States of America as a federally chartered branch, regulated by the Office of the Controller of the Currency and is not affiliated with either: (i) a broker dealer registered with the US Securities Exchange Commission; or (ii) a Futures Commission Merchant registered with the US Commodity Futures Trading Commission. If you wish to be removed from our e-mail, fax or mailing list please send an e-mail to |