Key points

- Key megatrends relevant for investors are: slower growth in household debt; the backlash against economic rationalism &rise of populism; geopolitical tensions; aging and slowing populations; low commodity prices; technological innovation &automation; the Asian ascendancy &China's growing middle class; rising environmental awareness; and the energy revolution.

- Most of these are constraining growth and hence investor returns. However, technological innovation remains positive for profits and some of these point to inflation bottoming.

Introduction

Recent developments – including the rise of populism, developments in the South China Sea and around commodity prices along with relentless technological innovation – have relevance for longer term trends likely to affect investors. So this note updates our analysis on longer term themes that will likely impact investment markets over the medium term, say the next 5-10 years. Being aware of such megatrends is critical given the short term noise that surrounds markets.

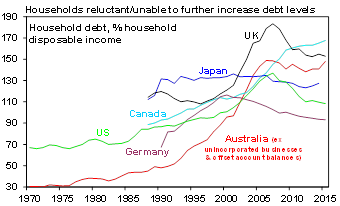

The super cycle slowdown in household debt

Household debt to income ratios surged from the late 1980s fuelled by low starting point debt levels, financial de-regulation and the shift from high to low interest rates. But it's likely run its course as the GFC and constrained economic growth have left consumers wary of adding to already high debt levels and banks' lending standards are now tougher. This has seen growth in debt slow & households run higher savings rates.

Source: OECD, RBA, AMP Capital

Implications – slower growth in household debt likely means slower growth in consumer spending, lower interest rates and central banks having to ease more to achieve a desired stimulus. Slower credit growth is also a drag for banks.

The backlash against economic rationalism

Its arguable that support for economic rationalist policies (deregulation, privatisation and globalisation) peaked over a decade ago. The corporate scandals that followed the tech wreck and the financial scandals that came with the GFC have seen an increase in regulation, the Doha trade round has been stalled for years and now the combination of slow post GFC growth and rising inequality (see the next chart) in the absence of the ability to take on more debt to maintain consumption growth are leading to growing populist angst. This is evident in the success of Donald Trump, the Brexit vote and the recent Australian Federal election. Of course this is just the way the secular political pendulum swings - from favouring free markets in the 1920s to regulation and big government into the 1970s, back to free markets in the 1980s and 1990s and now back the other way with each swing ultimately sowing the seeds for the next. But the risk is that the shift away from economic rationalist policies in favour of more populist policies will lead to slower productivity growth and ultimately rising inflation as the supply side of economies are damaged & easy fiscal policy is adopted.

Data is after taxes and welfare transfers. Source: OECD, AMP Capital

Implications – populist polices could slow productivity and set the scene for the next upswing in inflation.

Geopolitical tensions

The end of the cold war and the stabilising influence of the US as the dominant global power in its aftermath helped drive globalisation and the peace dividend post-1990. Now the relative decline of the US, the rise of China, Russia's attempt to revisit its Soviet past and efforts by other countries to fill the gap left by the US in various parts of the world are creating geopolitical tensions – what some have called a multi-polar world. This is evident in increasing tension in the Middle East between (Sunni) Saudi Arabia and (Shia) Iran; Russia's intervention in Ukraine; and tensions in the South China Sea (which have recently been increased by a UN sponsored international court ruling in favour of The Philippines regarding island disputes) and between China and Japan.

The demographics of aging and slowing populations have long been talked about but their impact is now upon us. We are living longer and healthier lives (eg, average life expectancy in Australia is already around 83 years and is projected to rise to 89 years by 2050) but falling fertility rates are leading to lower population growth. The impact is more significant in some countries, which are seeing their populations fall (eg, Japan, Italy and even China) than others (eg, Australia, where immigration and higher fertility is providing an offset) and others still where population growth remains rapid (eg, India, Africa and the Middle East).

Since around 2008 (for energy) and 2011 (for metals) the commodity super cycle has been in decline as the supply of commodities rose in response to last decade's commodity price boom combined with somewhat slower growth in China. However, after 50 to 80% peak to trough price declines and with supply starting to adjust for some commodities (eg oil) it's quite likely that we have seen the worst (in the absence of a 1930s style recession). This doesn't mean the next super cycle commodity upswing is near – rather a long period of base building is likely as we saw in the 1980s and 90s.

Source: Global Financial Data, Bloomberg, AMP Capital

Implications – Low commodity prices will act as a constraint on inflation and interest rates but the likelihood that we have seen the worst may also mean that the deflationary threat will start to recede. In other words it adds to the case for a bottom in global inflation. A range bound environment less clearly favours commodity user countries over producers.

Technological innovation & automation

The impact of technological innovation is continuing to escalate as everything gets connected to the internet. The work environment is being revolutionised enabling companies to increasingly locate parts of their operation to wherever costs are lowest and increasingly to automate and cut costs via automation, nanotechnology, 3D printing, etc. The intensified focus on labour saving is likely good for productivity and profit margins but ambiguous for consumer spending as it may constrain wages and worsen inequality and could ultimately hamper growth in emerging countries. There is also the ongoing debate that with so many "free" apps and productivity enhancements, growth in activity (GDP and hence productivity) is being underestimated/inflation overestimated and consumers are doing a lot better than weak wages growth implies. So fears around inequality and stagnant real incomes may be exaggerated. Time will tell.

Implications – technological innovation remains a reason for inflation to stay low and profit margins to remain high. But also a potential positive for growth.

Asian ascendancy & China's growing middle class

Low levels of urbanisation, income and industrialisation continue to mean that the emerging world offers far more growth potential than the developed world. While big parts of the emerging world have dropped the ball (South America and Russia particularly), the reform and growth story remains mostly alive in Asia – from China to India. Both China and India are seeing a surging middle class, with China's growing from just 5 million people 15 years ago to now 225 million. This means rising demand for services like healthcare, leisure & tourism.

Implications – favour non-Japan Asian shares (allowing of course for risk). Tourism and services should benefit particularly from the rising middle class in China and India.

The environment and social values

Concern about the environment is continuing to grow and higher social standards are being demanded of governments and corporates. This reflects a range of developments including increasing evidence of the impact of human activity on the environment, younger generations demanding higher standards and social media that can destroy reputations in a flash.

Implications – this will favour companies that adhere to high environmental, social and governance standards.

The energy revolution

Renewables share of power production will only grow as alternatives like solar continue to collapse in cost and solar energy storage becomes mainstream. Likewise advances in battery technology are seeing a massive expansion in the use of electric cars which will feed on itself.

Implications – this has huge negative implications for oil and coal and along with the impact of shale oil production will keep a ceiling on energy prices.

Implications

At a general level there are several implications for investors

- Firstly – several of these trends will help keep inflation low, eg, slower growth in household debt, low commodity prices automation & the energy revolution. By the same token if commodity prices have seen the worst and government policy shifts towards stimulus we may have seen the worst of deflationary and disinflationary pressures.

- Secondly – several are also consistent with constrained economic growth, notably aging and slowing populations, slower growth in debt, the backlash against free markets and geopolitical tensions. This is not universal though as increasing automation is positive for profits.

- This is all still consistent with ongoing relatively low interest rates (albeit we are likely around the bottom) and relatively constrained medium term investment returns.

- Several sectors stand out as winners including health care and leisure but producers of energy from fossil fuels are potential losers.